UPDATE (Jun/03/05:54)

UPDATE

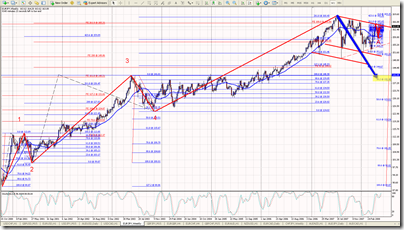

A bullish retracement inside the bearish movement.

This divergnce, also confirmed in M30 & M15, reinforeces such a retracement.

ORIGINAL POST

Looking at the Monthly time frame, we can se that the pair is clearly retracing form the last down movement.

That ratracement is by now around the 38.2 level, which could be the point "B" of a possible "BAT" pattern.

Elliott Wave count give us a 5 wave movement to the upside, which can be the wave "A" of an "ABC" corrective pattern, so one can expect the price to go down now, unfoldong the correction of the actual 5 waves movement.

In the Weekly time frame, we can see that the retracement for the 5 waves impulsive movement to the upside, bearly went a little below the 23.6 fib level, which is not a common level to find support, so we can expect the price to continue going down looking for the 38.2 .

There is an important triangle that seems to be is being repected, meaning that even though price is retracing, it will not necessary do down to 38.2 level, so, for now, i will trade just the triangle, having as target the lower edge of it.

Additionally to the triangle, i see a bearish BAT. This one i will trade with an entry at the break of the 38.2 fibfan level in the H4 time frame.

2 Targets. 1st. one, as my Money Management, 30 pips. The 2nd, as a free trade, looking for the lower edge of the triange, moving SL every 30 pips gained.

This is another point of view...

No hay comentarios.:

Publicar un comentario