martes, 31 de marzo de 2009

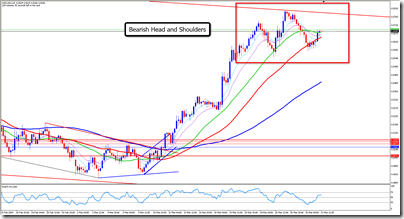

NZDUSD Bearish Head and Shoulders

A very nice and clear Head and Shoulders, with all the “textbook” elements can be seen in this pair.

As we can see, the precedent Bearish Butterfly Harmonic Pattern is very clear and confirmed by price action after 0.5787 high. Also the Double top almost occurred at this level confirms the presence of a H&S pattern.

I expect price to go begin drop at 0.5664 – 0.5716 area, to conform the right shoulder of the pattern.

Even though the potential of the pattern is around 220 pips, this reversing point can move price 500 pips down to 0.5100 level and after that (deeper), can signifies the weekly bearish trend resuming after a 924 pips pullback from 0.4890.

-

jueves, 26 de marzo de 2009

USDCOP, seguimiento a la corrección

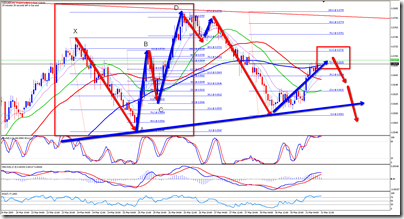

Aparentemente la ruptura de la línea de tendencia que esperábamos fuera confirmada con un “retest” de la misma, no se dio esta vez.

Sin embargo, sigo considerando que la caída desde 2.608 es, por ahora, un movimiento correctivo que aparentemente ha terminado el desarrollo de su segmento A en el nivel de 2.320.01. Actualmente estaríamos moviéndonos en el segmento B.

La proyección del desarrollo del patrón se puede ver claramente en la grafica.

Es importante resaltar que este segmento B, que implica fortaleza en el dólar contra el peso, coincide con la fortaleza del dólar en los mercados mundiales, producto de la corrección después del debilitamiento experimentado entre el 6 y el 19 de Marzo.

-

martes, 24 de marzo de 2009

CITI, otra posibilidad

Es importante considerar que CITI podría estar desarrollando un patrón Armónico tipo Gartley, lo cual se vería confirmado si el precio no logra superar los máximos anteriores y, por el contrario, experimente un mínimo menor a 2.38.

Dicho patrón, si bien implicaría volver a niveles no deseados entre 2.12 a 1.79, contribuiría a la tesis de que el precio de esta acción se esta empezando a mover técnicamente.

Posteriormente al desarrollo de este patrón, la acción retomaría su camino al alza.

desde el punto de vista de Elliott Wave Theory, un mínimo mayor en el nivel de 2.12 a 1.79 seria la definición de una onda 2

CITI, ¿empieza a moverse técnicamente?

Se empiezan a identificar movimientos técnicos en esta acción.

Lo primero que podemos ver es el establecimiento de una tendencia alcista en la franja de 1 hora., tal y como lo muestran los promedios móviles de 35, 50 y 100 períodos, todos apuntando en el mismo sentido y paralelos.

Como confirmación de lo anterior, podemos ver que el precio ha respetado el “Área Dinámica de Reacción”, comprendida entre los promedios móviles de 30 y 50. Esta área se debe comportar como una barrera en la que el precio debe rebotar cuando se trata de tendencias “sanas” (ver recuadros verdes).

Por otro lado, es importante resaltar que el precio esta intentando romper una línea de tendencia bajista importante (Ver recuadros rojos).

La entrada en el canal del 38.2% FibFan que nos debe llevar por lo menos a niveles de 4.3/5.0, se vio ralentizada por el ultimo intento fallido por romper dicha línea de tendencia.

Rota la línea de tendencia, podremos esperar máximos mayores con mas facilidad.

USDCOP, Confirmando Bearish Breakout

La línea de tendencia alcista ha sido violada y actualmente el precio esta confirmando dicha violación volviendo a tocarla (retest). Se espera que una vez hecho esto el precio siga bajando para lograr un nuevo mínimo que confirmaría un cambio de tendencia, esta vez, a la baja.

Los objetivos se mantienen tal y como se planteo en un post anterior: 2.238 , 2.124 y 2.009 .

Ver http://gustavoforex.blogspot.com/2009/03/usdcop-correccion-la-vista.html

-

jueves, 19 de marzo de 2009

EURAUD, Triangle break approaching

USDCOP, hoy puede ser un día movido

La decisión anunciada ayer por la FOMC de comprar bonos del tesoro a largo plazo y activos tóxicos del mercado de hipotecas, generó un debilitamiento inmediato – esperado pero no tan rápido – del dólar contra todas las divisas.

Hasta ayer, el forecast de la semana pasada ha venido desarrollándose de acuerdo a lo esperado.

Proyectado

Actualización

El movimiento de hoy podría ser acelerado a la baja como consecuencia de lo dicho anteriormente.

Para detalles del anterior forecast, ver:

http://gustavoforex.blogspot.com/2009/03/usdcop-correccion-la-vista.html

-

miércoles, 18 de marzo de 2009

USDCAD Bearish H&S unfolded

This forecast was done on march 10, 2009. See it at: http://gustavoforex.blogspot.com/2009/03/usdcad-bearish-scenario-h-in-h1.html

-

martes, 17 de marzo de 2009

lunes, 16 de marzo de 2009

GBPUSD follow up

USDJPY follow up

GBPUSD, pick the bus

After the lost H&S entry, i think this one could be a good one.

Note that price is finding support in a previous high @ 2009.03.13, 1.4066. Also, this level corresponds to 50% fib ret and 61.8 fibfan of the previous swing in 1 hour time frame. additionally, is retesting broken bearish trend line.

First target is set to the touch of the 38.2 fibfan level.

-

viernes, 13 de marzo de 2009

USDCOP, corrección a la vista

Es claro que el movimiento alcista desde el nivel de 1.600 esta compuesto por 5 ondas impulsivas. El movimiento bajista de esta semana puede ser el inicio de la corrección correspondiente al movimiento anteriormente mencionado.

Sin embargo, dicha corrección solo será confirmada con el rompimiento de la línea de tendencia alcista y el ingreso a los fibfans trazados entre 1.638 (mínimo) y 2.610 (máximo).

Si se confirma la corrección, las tres ondas correctivas podrían desenvolverse de la manera planteada en la grafica, teniendo en cuenta que el precio podría encontrar soporte en el limite del fan 38.2% y retroceder a confirmar el rompimiento de la línea de tendencia.

De todas formas, es importante transar en función de los siguientes niveles Fibonacci : 2.238 (38.2%), 2.124 (50%) y 2.009 (61.8%).

-